The essential answer

Muslims who solely own wealth types that the Prophet, on him be peace, declared subject to zakat — currency, crops and produce, livestock, and treasure troves — for an Islamic Hijri lunar year (or at harvest) in amounts on which zakat from it becomes mandatory must pay there zakat only to some or all of the eight kinds of people Allah designated as zakat-eligible:

The poor

The indigent

Zakat workers

Those deserving financial reconciliation

The enslaved and captive in bondage to free them

The debt-ridden

Those physically struggling for Allah’s cause

The stranded separated from their wealth.

Zakat can only be used to enrich these qualified Muslims.

Can Muslims pay their zakat to good Islamic causes?

No. To think clearly about this type of zakat, keep two principles in mind:

Allah imposed zakat al-mal — as its name “the obligatory wealth alms” says — on the wealth of the believers when it reaches certain thresholds and times.

Allah restricted entitlement to zakat payment individual believers who meet the wealth deficiencies or personal forfeitures He identified.

Based on this, a substantial number of organizations and institutions that declare their work zakat-eligible — from political action groups to mosques and schools — are not properly zakat-worthy, unless they are directly delivering this zakat to enrich people in the eight categories of Muslims whom Allah has specified.

(See Can Zakat Be Paid for a Mosque?)

This includes humanitarian agencies — including very large and well-known ones — who have begun collecting zakat from Muslims but who, as non-Muslims, are ineligible to collect it to begin with or who do not exclusively deliver 100% of that zakat to these “zakatable” (zakat-eligible) Muslims.

How can I ensure my zakat is correctly calculated and rightfully distributed?

Allah and His Prophet, on him be peace, institutionalized the mandatory assessment collection and distribution of zakat within the Muslim Ummah (or community) through its established leadership and the mechanisms these governmental authorities created.

We do not, by and large, have this kind of legitimate authority and mechanisms to manage zakat’s proper assessment, collection, and distribution today. In this case, the authority for this obligation of zakat’s assessment, collection, and distribution devolves on us individually as believers.

The worthiest recipients of your zakat are your nearest eligible relatives, provided they are not already your dependents in the eyes of Islam, then your closest Muslim neighbors, then the Muslims of your locality.

(See Can Zakat Be Given to Family?)

However, some variously self-defined “local” Muslim zakat agencies have presented zakat distribution as absolutely and unexceptionably only Islamically legitimate if it is distributed locally (while they arrogate to themselves the right of determining what constitutes “local”). In this, they seek to delegitimize international Muslim charities that distribute some collected zakat to the war-, climate-, and natural-disaster-stricken beyond the variously defined localities of their payers.

Such an unequivocal ruling is misleading and false — and this is especially the case in our times when Muslims in the global community suffer incalculable devastation from human- and climate-generated catastrophes, along with other natural disasters, to the extent that Muslims make up by far the largest populations of orphans, widows, refugees, displaced persons, and impoverished in the world.

The Prophet, on him be peace, the Righteous Caliphs, later zakat authorities, and virtually all the schools of Islamic Law practiced or allowed for transporting zakat beyond one’s locality with cause.

In terms of correctly assessing your due zakat and ensuring its proper distribution, Muslims have very responsibly and admirably created zakat institutions and humanitarian organizations that help you calculate and pay your zakat.

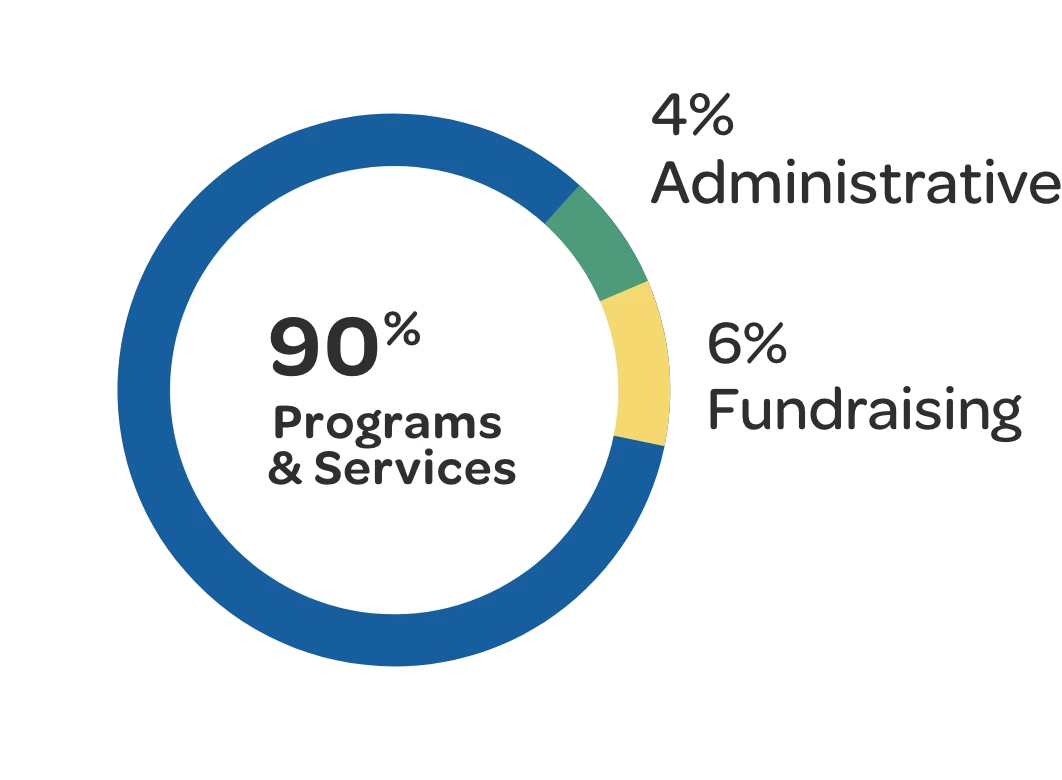

Zakat Foundation of America, established in 2001 and the publisher of this blog, is one of these dedicated charities. A full 100% of its collected zakat reaches zakat-eligible recipients. You can use its Zakat Calculator to determine and make your zakat payment. You can also order The Zakat Handbook (2nd Ed), which will answer most of your Zakat questions and has a simplified and updated Zakat Calculator.

For more on choosing an organization to pay your Zakat to for proper distribution see What Makes a Non-Profit Organization Zakat Eligible?

For a more in-depth look at Zakat Al-Mal see How Is Zakat Calculated on Wealth?and What Requirements Qualify Wealth for Zakat?