In Brief

Zakat is paid on both income and savings that reach the set Zakat threshold (nisab) for money (the currency value of 85gm of gold) and its due date of maturity, but never does one pay Zakat twice on the same wealth in a single Zakat year. (See What Is Nisab in Islam?)

These common forms of income in our time — worker wages and professional salaries — did not exist in the days of the great legal (fiqhi) scholars of the pre-modern era. So the competing opinions about paying Zakat on these forms of wealth issue mostly from contemporary Muslim scholars, who have derived them based on analogy and legal rationale from well-established rulings (ahkam, s. hukm) and positions.

A Neccessary Aside

Do not get frustrated or confused with differing legal rulings in Islam.

There is variance of legal opinion and nuance in this matter of Zakat on income, which matches the distinct differences in the human experience, native understanding, and scholarly method in working from original sources of Revelation, from which all Law must derive in Islam.

This ambiguity in legal opinion is one of the great hallmarks of Islam’s mature application of the believing human understanding of Revealed Shari‘ah Law (fiqh). This is markedly different than the one-size-fits-all, black and white, and wildly shifting morally relative bases for human-originated and pronounced “legality and illegality.” These are common in the age of the secular and in the context of the super-tribalism of the all-powerful and intrusive nation-state of the times in which we live. Indeed, the variance of opinion by qualified Muslim legal scholars is a Godly mercy upon humanity and a major sign of Islam’s Divine origin.

Then contrary to what some Muslim academics have in recent years written in university business journals about Zakat as it is recommended to and practiced by American Muslims, this variance of opinion and option in Islam’s rulings on Zakat is neither unfair nor a cause for Zakat inequality; nor does it constitute a personal moral hazard for Muslim Zakat payers.

Rather, inequity in Zakat payment specifically will come about if we attempt to satisfy the ignorant urge common in our time for one legal ruling, and one legal ruling body, that standardizes all Zakat regulations for all people, and then imposes this on them, removing their God-given right of free interaction with as many Islamic legal scholars and schools of thought as they desire and selection of the opinion and legal way they feel most in harmony with.

Eight Baseline Zakat Tenets for Currency

When it comes to money, Zakat is owed:

From you as a Muslim, regardless of your age, gender, or mental status

On all that you have accumulated of it in all forms of currency added together as its sole owner

After an Islamic lunar year (hawl) has passed on it, or you have gathered it in lump sum

If it equals or exceeds the currency value threshold (nisab) of 85 grams of gold

On the day your Zakat payment comes due

After you pay or account for your current immediate debts and essential living expenses (personal and for your family and household)

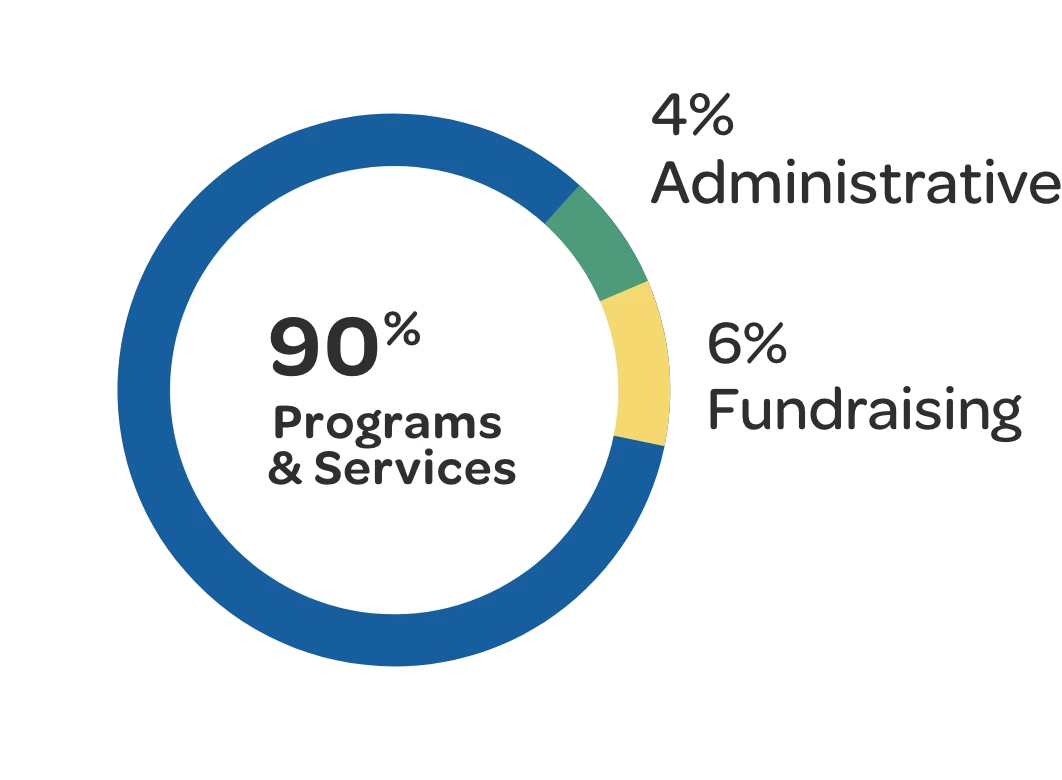

At a rate of 2.5% of your total remaining monies at the time you make your payment

Can you explain this?

Let’s first define the Zakat vocabulary we’re using:

Currency means bills or banknotes, coinage, gold and silver, and all stores of value that can be readily used or converted into money (see Zakat on Jewelry).

Income in our time translates for most of us into money we make, usually on a regular basis, from work or investments.

Zakat Due Date (ZDD) is the day of the Islamic lunar year that you pay your Zakat on that type of eligible (Zakatable) wealth. Different wealth types can have different Zakat Due Dates. So Zakat on Zakatable crops is due at the time of harvest. Zakat on eligible livestock is due a year from the day you acquired or started your herd in numbers sufficient to reach their established threshold (nisab) to require Zakat from them. Not all animals require Zakat, and different livestock have different threshold numbers (nisab).

Total Accumulation for the purposes of Zakat on currency means all the money that remains in your possession after immediate debts and living expenses are paid or accounted for.

So, if you have a mortgage payment due in the month of Zakat payment, you deduct that month’s payment but not the entire mortgage debt. It is the same for other kinds of structured debt.

You deduct your food, utility, transportation, education, health care, and other living essentials debt for that immediate period before tabulating your total accumulation of currency value. If that period is a week, bi-weekly, monthly, etc., that is what you account for.

If a person is not paid on a schedule but his or her business or dealings has a pattern of earnings, one still tabulates total accumulation and pays Zakat on it.

Sole Ownership means no one else but you has a right to your money. Even if your practice is to freely share your money with another, the Zakat responsibility remains yours as its true possessor

Islam’s Lunar Year runs through the 12 crescent-to-crescent moon cycles, or months, from 1 Muharram (its first divinely decreed month) to the last day of Dhu’l Hijjah (its 12th divinely decreed month), which will be either 29 or 30 days long depending on the establishment of the new month’s (Muharram’s) crescent.

This makes the Islamic lunar year 354 to 355 days long, about 10 to 11 days shorter than the solar year. This means the Islamic year is a true lunar year whose months roll back through the solar year and seasons.

As for the Zakat year (hawl), it becomes complete on the same lunar day of the Islamic month one year after the Zakat payer’s particular wealth accumulation reached its Zakat threshold. If that day was the 30th lunar day of a month that the next year only has 29 days, one can pay his or her Zakat on the last day of that month, or the 1st of the subsequent month. The Islamic day begins at sunset.

Threshold Origin (Nisab) is the amount of wealth type, or asset, where the right of the poor and Zakat-eligible begin in that wealth holding of another Muslim. Different kinds of wealth have different nisab thresholds as established by the Prophet, on him be peace. Muslim scholars have generally long agreed that the nisab for currency equals the value of 85 grams of gold in the currency one will use to pay his or her Zakat at the Zakat Due Date. (See Nisab and Zakat Calculation in a Nutshell)

Zakat Rates for different types of Zakat-eligible wealth were set by the Prophet, on him be peace. The Zakat rate on money is 2.5%.

Now we can raise the proper questions about Zakat on income.

Is Zakat due on earnings?

Yes. Allah has said:

O you who believe! Spend charitably from the wholesome things you have earned and from all We have brought forth for you from the earth” (Surat Al-Baqarah, 2:267).

Income is, by definition, earning. While earning may include profit from sales, the birth of livestock, or produce sold — the Zakat of all of which comes due when totaled with other like holdings on the passing of their Zakat year — we are talking about Zakat on salary and wages as income.

Does one Islamic year have to pass on earnings for its Zakat to come due?

This is the major question of dispute between scholars when it comes to Zakat on income.

The norm for legal rulings (ahkam) in Islam is that Allah imposes a general rule and the Prophet, on him be peace, specifies how to carry out the obligation(s) it entails and sets its limits.

So while we see the general Text on “spending charitably” from our earnings, there is no agreed-upon authentic report from the Prophet, on him be peace, requiring the passage of a year specifically on income earnings.

The Companions, Allah be pleased with them, did address this. However, some required a year to pass on earned income, others ruled that one should pay Zakat on earned income that meets the nisab threshold (after deduction of immediate debts, essential life needs, etc.) when that income is received.

Abu Bakr, Aisha, Ali, and Ibn Umar, Allah be pleased with them, required the passage of a year on earned income. Ibn Abbas and Ibn Mas‘ud, Allah be pleased with them, did not and stipulated Zakat on earned income as it is acquired and qualifies. Ibn Abbas reportedly said of an income earner whose wealth qualifies for Zakat: “He must pay Zakat on it the day he acquires it” (Al-Amwal).

Many prominent Successors, like Umar Ibn Abd Al-Aziz as Caliph, followed this opinion and collected Zakat on earned income from Muslims as they acquired it.

The disagreement of the Companions on this means legal scholars must enter and make their best judgment on discerning the rule of the passage of time for Zakat on earned income.

What legal Text do scholars use to justify Zakat on earned income as soon as one gets it?

They cite the authentic and agreed-upon hadith of the Prophet, on him be peace: “On the dirham [silver currency] 2.5 percent is due.” This is a general statement that does not specify time passage.

They say that Zakat came due on money at the end of the Zakat year, whenever it was declared for the Zakat collectors of the Prophet, on him be peace, as long as it reached nisab at that time without consideration for its nisab at the beginning of the year. The point of the declared Zakat year’s end ensured that Zakat was not taken twice from the same wealth within one year.

The main four schools of Islamic Law set various requirements for the passage of a year for Zakat on earned income, but they disagree on the reason for this and have complex competing stipulations for the passage of a year that make discerning adherence difficult now for us, especially since they were not addressing salary and wages specifically in the matter of earned income because it wasn’t a feature of financial life in their times. Nonetheless, the contradictions between them show there is nothing like legal agreement in this matter of the passage of year on earned income.

Hanbali scholars who support immediate Zakat on qualified earned income make analogy with the position of Ahmad ibn Hanbal, the school’s namesake, for Zakat on rent, that it comes due from it immediately upon receipt.

Abu Hanifah required the passage of a year on earned income that reached nisab, unless it was being added to like assets already in the possession of the owner, raising that asset to the nisab threshold.

Malik’s position requires a year to pass on the asset for Zakat to come due, even if the owner already has a like asset (except if the increase is in livestock that then reaches its nisab).

Al-Shafi’i holds a more restrictive position when it comes to livestock, but he too requires the passage of a year on earned income.

This Brings Us to Our Original Two-Part Question

Is Zakat due on savings?

Yes, Zakat is due on all savings. Pay your Zakat on it at its one-year Zakat Due Date (ZDD). (If you don’t have a ZDD, establish one. Ramadan is a great time to pay Zakat.)

Keep in mind that Zakat is due at its time and nisab threshold on all money — in hand, in your pocket, in a bank, in your mattress, in bills, in bank notes, in a check, in coinage, in gold, silver, or other precious metals that store value, in cashable policies like life insurance plans, in tax-deferred accounts (with special calculations), for capital gains — on all assets that are readily convertible as money.

Is Zakat due on earned income in the form of salaries or wages?

Yes, Zakat is due on earned income that meets the threshold of nisab (currency value of 85gm of gold at the time of Zakat payment).

Is Zakat due on earned income upon receipt?

Yes, in this opinion, which is considered strong. The best analogy for earned income is crops. Zakat comes due on crops at harvest. If you go back to the Quranic ayah cited at the beginning of this writing as the Text justifying Zakat on earnings, you’ll see that Allah Himself couples earning with what the earth produces for people:

“O you who believe! Spend charitably from the wholesome things you have earned and from all that We have brought forth for you from the earth” (Surat Al-Baqarah, 2:267).

To require Zakat immediately from farmers while exempting professionals and wage earners is to create a Zakat exception for often very highly paid employees, who may spend extravagantly and thus at year’s end have no Zakat to pay on their earnings, while others will pay Zakat on their much more modest earnings; or in the case of the farmer, what he or she must pay at time of harvest.

For reference, an entry-level lawyer in big law, or a new executive in the financial sector, or a just-hired physician earning $16,000 per month (this is common and not high-end) is making 3.3 times more than the nisab of $4,743.85 at the time of this writing. He or she can literally double this amount in debt and expenses for the month and still have surplus to pay Zakat on, which is, after all, the abundance on which Zakat payment comes due.

Requiring Zakat on wage and salary earners in our times, who — in close intervals of income — meet or exceed nisab each time they get paid, after their immediate debts and essential life expenses, is far, far more beneficial to the poor and the indigent, and the other six categories of Zakat recipients Allah has specified as its rightful owners.

It is much easier and safer for Zakat payers in this category of high periodic earnings to pay Zakat as soon as they acquire its nisab, after the deduction of immediate debts and essential living expenses, than it is to wait for the end of the year.

Easier because the payer would have to keep extensive records on all spending, down to the penny, and across all categories of wealth to accurately calculate Zakat at the end of the year.

Safer because due Zakat left unpaid destroys one’s wealth. The Prophet, on him be peace, said:

A person’s Zakat does not remain mixed with his other wealth without obliterating it” (Bukhari, in his Tarikh Al-Kabir, The Large History of Hadith Narrators).

Can I pay my Zakat on earned income at the end of my fiscal Zakat year?

Yes, but you must pay it on the total sum of your net income, deducting only (1) your essential personal and family life needs (food, housing, transportation, utilities, health care, education, and the like) and (2) your immediate debts (your entire mortgage, for example, or car payments are not deductible, just the monthly payment due on them).

If you choose to spend your earning income and pay Zakat on it at the end of the year, whatever other monies you come into — even from non-Zakatable items (say you sold your house and now have that money, inheritance, and so on) — you must add to your net income and all other monies you possess at that time, even if you just received it that day, and pay your Zakat on all of it totaled together.

Again, waiting till year’s end for Zakat payment on earned income is not recommended for the reasons stated in the previous question.

When should I pay my Zakat on earned income?

You should pay it as you acquire it in amounts equal to or above the nisab threshold. If your payments come in at separate but close intervals (say in a month), then calculate all your earned income over that designated period, deduct immediate debt and essential living expenses, and pay Zakat on what remains.

What is the Zakat rate on earned income?

The established Zakat rate for money is 2.5%. You should pay this in Zakat on your net earnings in your set earning period that reach nisab after proper deductions.